Clichés

Three fallacies on money and inflation

Créé le

11.03.2016Contrary to conventional wisdom, central banks cannot control inflation. They should therefore give up inflation targeting and embrace monetary reform. What we need is “active” (or “positive”) money, issued by public and private issuers (e.g., central banks issuing 100% money and private issuers producing bitcoins by validating transactions in the blockchain).

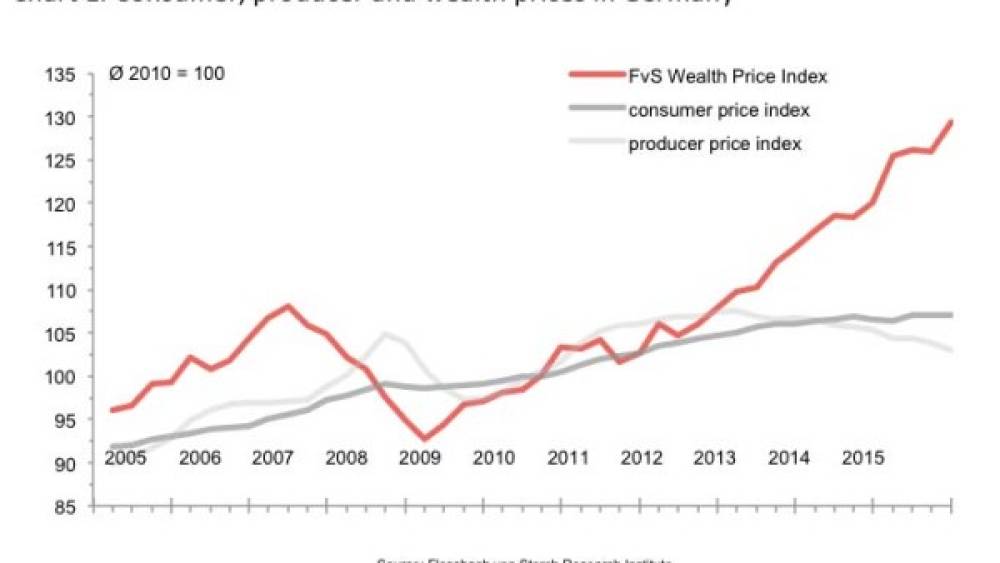

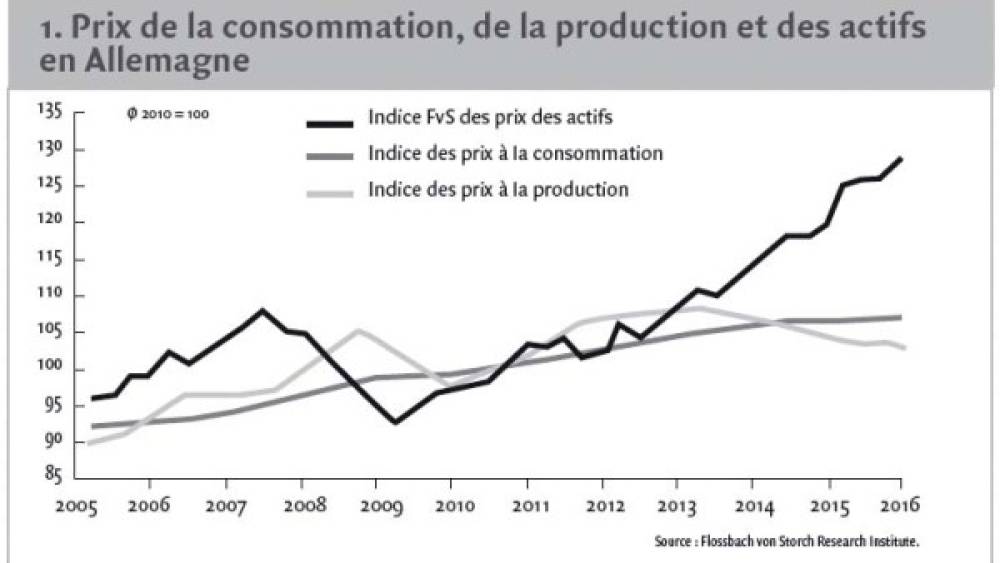

Our understanding of the relationship between money and inflation seems to go around in circles. In the 1960s and 1970s, economists in general and central bankers in particular paid little attention to money. This changed in the 1980s, when money was seen as the key driver for inflation. Today, we seem to have returned to the view that money does not matter (or at least not very much). In my view, the ambiguity on money is related to conventional economics’ lack of understanding of the creation of money. Conventional economics treats money like a good: its exchange value declines when there ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)