Market impacts

ESG Concerns Are Driving more Forceful Asset Manager Stewardship

Créé le

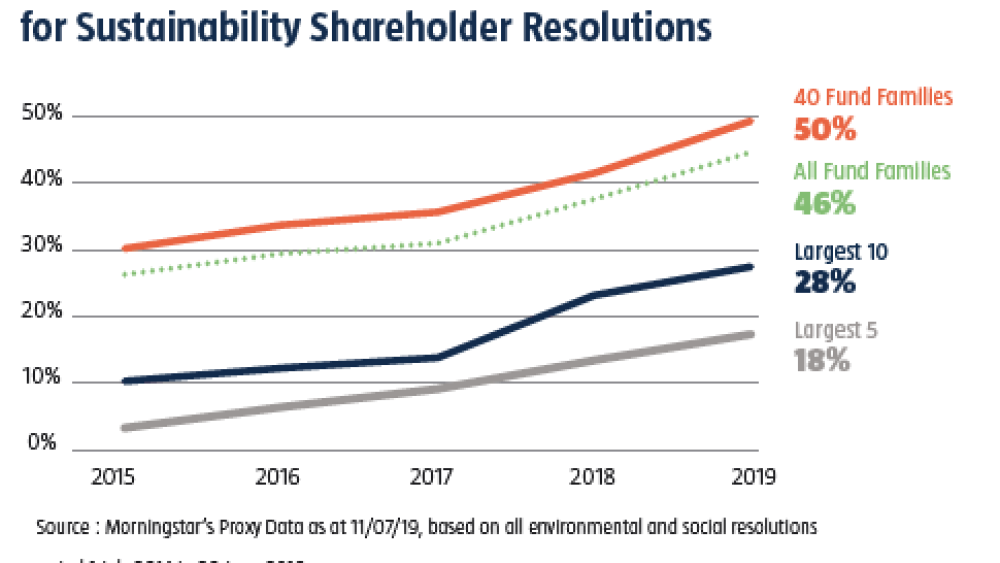

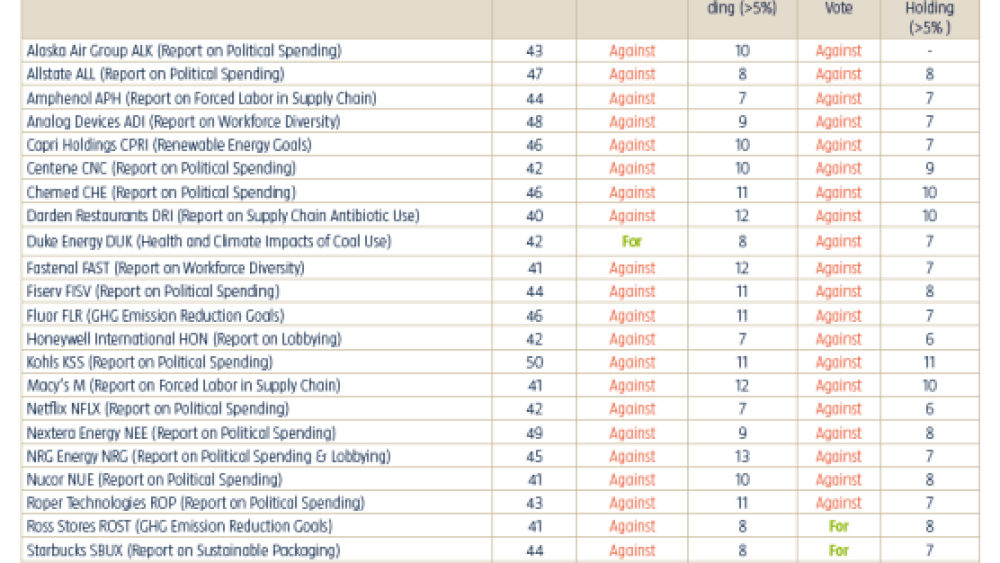

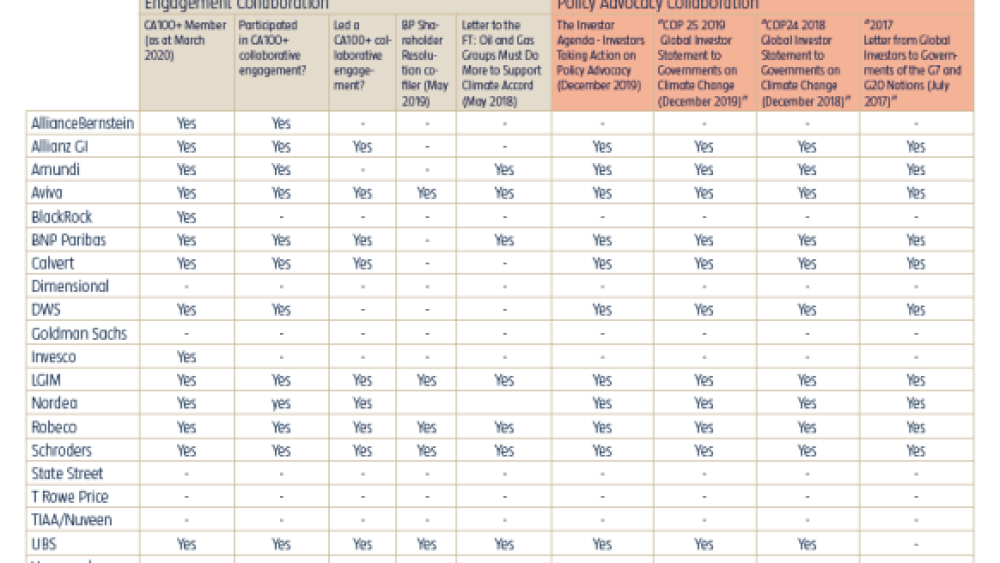

07.05.2020With large asset managers controlling significant portions of the vote at most public listed companies, it matters a great deal how they cast their votes on important issues that shape market-wide risks such as climate change, biodiversity loss, human rights and political capture. This article reviews recent Morningstar research on proxy voting and climate-related engagement practices by large global asset managers.

How large asset managers exercise their control rights is an important part of the investment process.

Active ownership, or investment stewardship, includes proxy voting, engagement, and other forms of influence that investors can use as financial stakeholders. These forms of influence can be used in combination as complementary strategies to manage investment risk and create investment opportunities.

By voting on items that appear on corporate proxy ballots, shareholders can shape corporate governance practices. The influence exerted through proxy voting can be leveraged in asset managers’ ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)