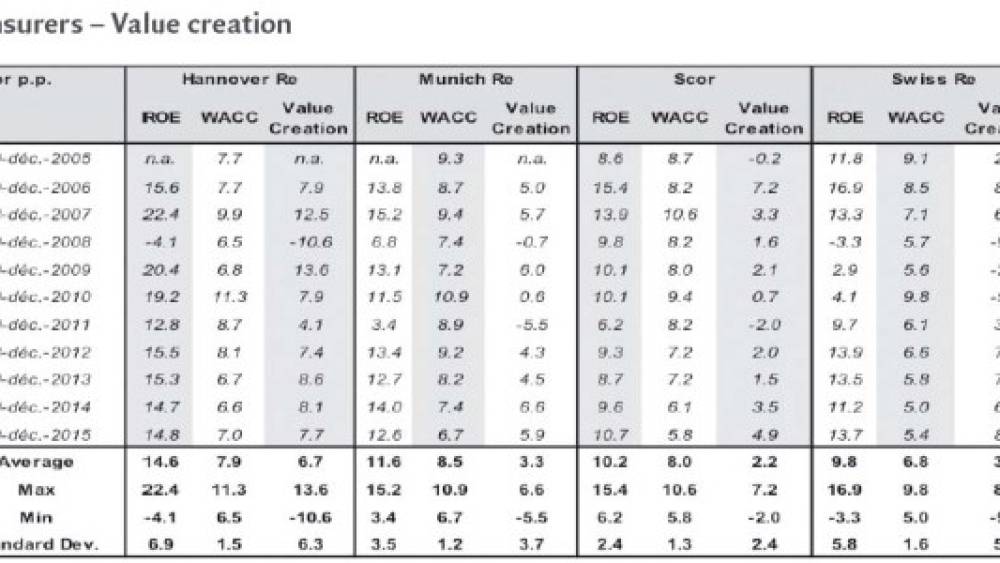

Profitability under Solvency II

Solvency II will Lead to Higher ROE for European Re/Insurers – At what Cost?

Créé le

12.04.2016-

Mis à jour le

08.04.2019Entrée en vigueur le 1er janvier 2016, la directive Solvabilité 2 adopte une approche économique, quand Solvabilité 1 se basait sur une approche prudentielle. L’article se demande si Solvabilité 2 va faire croître la rentabilité (ROE) des assureurs et réassureurs européens alors qu’ils vont optimiser la structure de leur capital, et à quel coût.

Solvency II was finally implemented on 1st January 2016 after numerous amendments and delays. The Solvency II project has been in development for more than fifteen years with the aim of modernising the prudential regulation of insurers and reinsurers across the European Economic Area (EEA). The goal was to create a harmonised EU wide insurance regulatory regime which included more robust capital requirements, improved valuation techniques, stronger risk management and governance standards for the European insurance sector. In moving away from a simplistic Solvency I approach set up in the 70s, ...