Green Bonds and Yieldcos

Innovative Instruments to Scale up Institutional Investment in Renewable Energy in Developing Countries

Créé le

28.06.2021Because there is an overall lack of investment vehicles and funds in developing countries that match institutional investors’ risk-return trade-off, renewable energy developers are constrained to seek financing via public institutions. Nevertheless, innovative capital market instruments, namely green bonds and yieldcos, have emerged and opened up new channels to attract institutional capital.

Challenges of attracting institutional investment

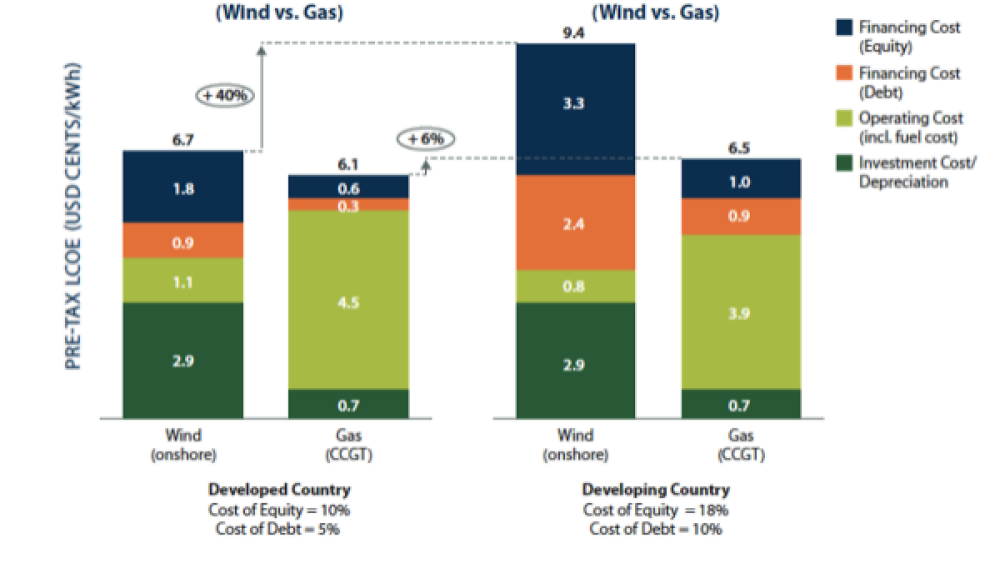

Standing in the way of an increased involvement from institutional investors are risks related to renewable energy (RE) and other reflecting challenges from investing in emerging countries. One of the specificities of RE projects compared to their conventional energy peers is the large upfront investment costs. While investment costs account for approximately 80 % of the total technology costs for wind energy, they only amount to 15 % in the case of gas.

On the graph 1, the pre-tax levelized cost of electricity (LCOE) for onshore wind and combined ...