In case of difficulty

An Effective Recovery and Resolution Regime for CCPs

Créé le

05.02.2015-

Mis à jour le

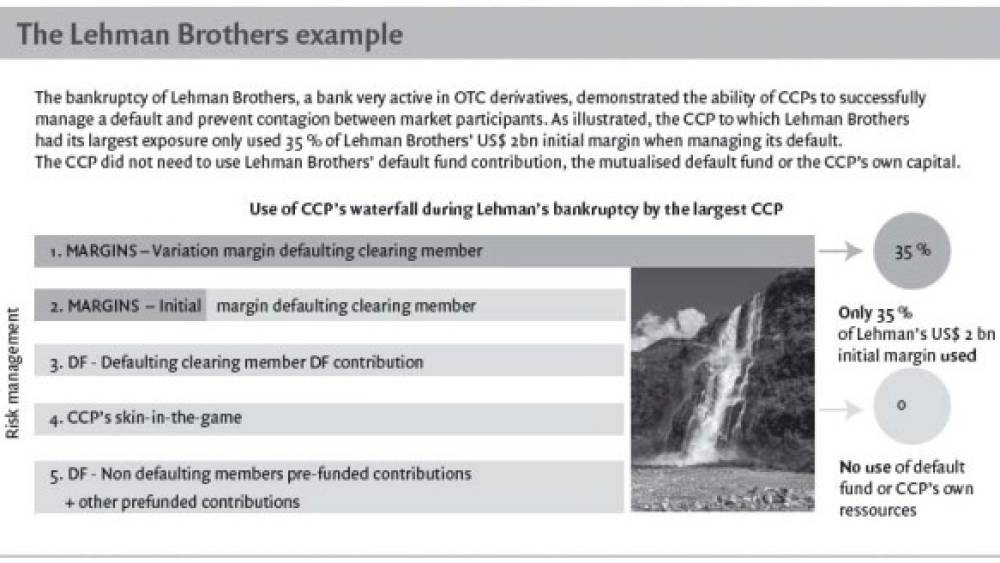

12.02.2015Le bon comportement de la CCP à laquelle Lehman Brothers était principalement exposé a montré que les chambres de compensation sont robustes. Leur solidité a encore été renforcée par EMIR, mais cela n'empêche pas les régulateurs de prévoir des procédures de redressement et de résolution.

OTC derivatives played a role in the financial crisis that erupted in 2008. The European Commission criticised the opacity of the market and the lack of adequate risk management[1] .

As a result of the crisis, on 25 September 2009, the G20 Leaders agreed on a set of measures to improve the functioning of the OTC derivatives markets by increasing their transparency and risk management and protection against market abuse.

The measures agreed were:

Trading of all standardised OTC derivatives contracts on exchanges or electronic trading platforms; Clearing of all standardised OTC derivatives contracts ...