IPOs

Why Do Companies Go Public on a Foreign Exchange?

Créé le

31.05.2016-

Mis à jour le

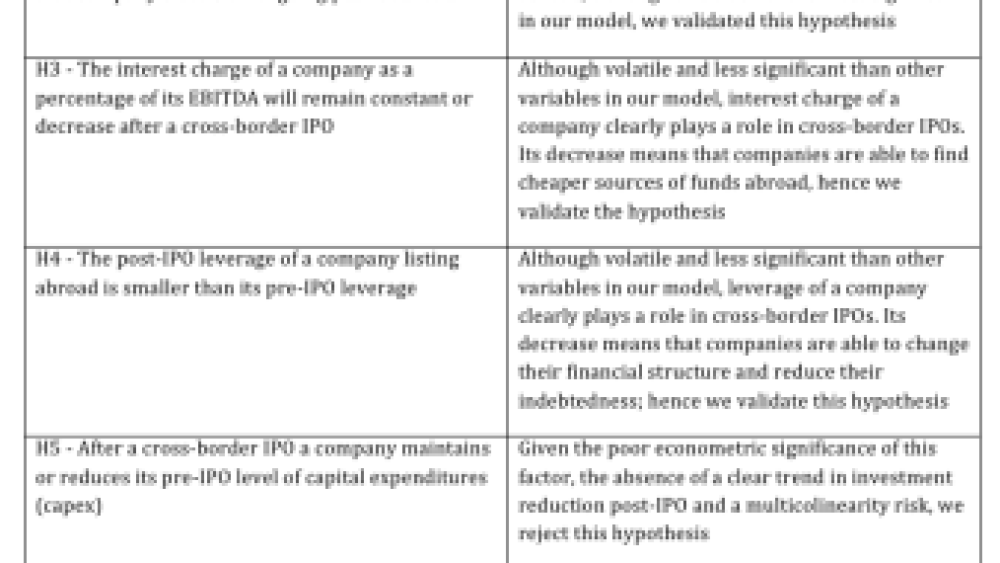

30.06.2016This article explores both the financial and non-financial motivations underlying Chinese cross-border IPOs, on both NYSE and NASDAQ. Our research finds that cross-border IPO decisions are primarily driven by visibility concerns and financial factors such as company size, international exposure and reducing financing costs.

Seventeen years after Pagano, Panetta and Zingales's founding article on why companies go public (see Pagano & al., 1998), the motivations underlying the choice of going public are still quite scarcely explored. Yet in today's equity capital markets context, characterized among other things by a strong internationalization of capital flows, enhanced regulatory complexity and higher volatility (as proven by the recent Chinese equity market rout in August 2015 and countless other episodes), companies should consider the choice of going public even more carefully.

This recommendation applies especially ...