Private equity

Skepticism around RLBOs

Créé le

07.06.2016-

Mis à jour le

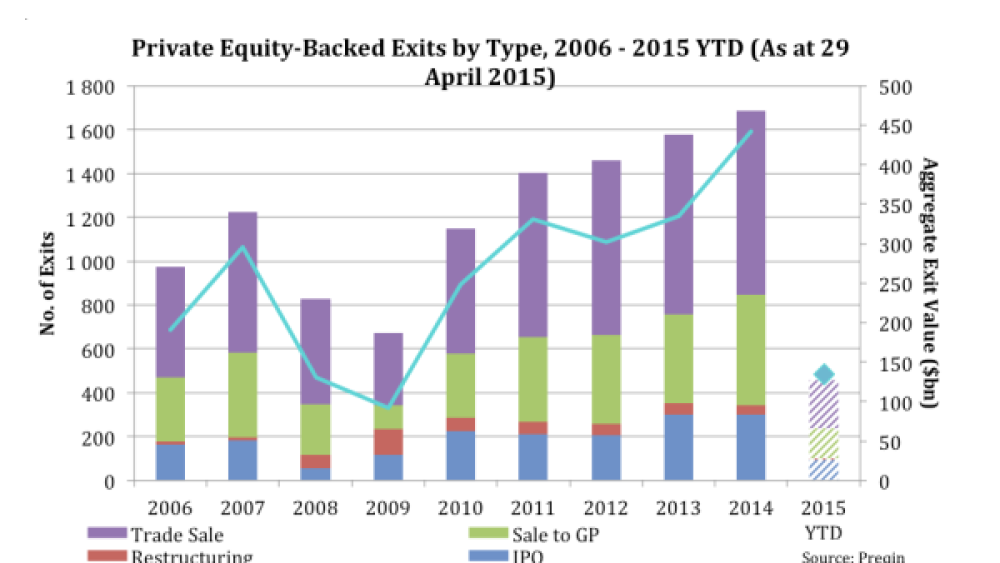

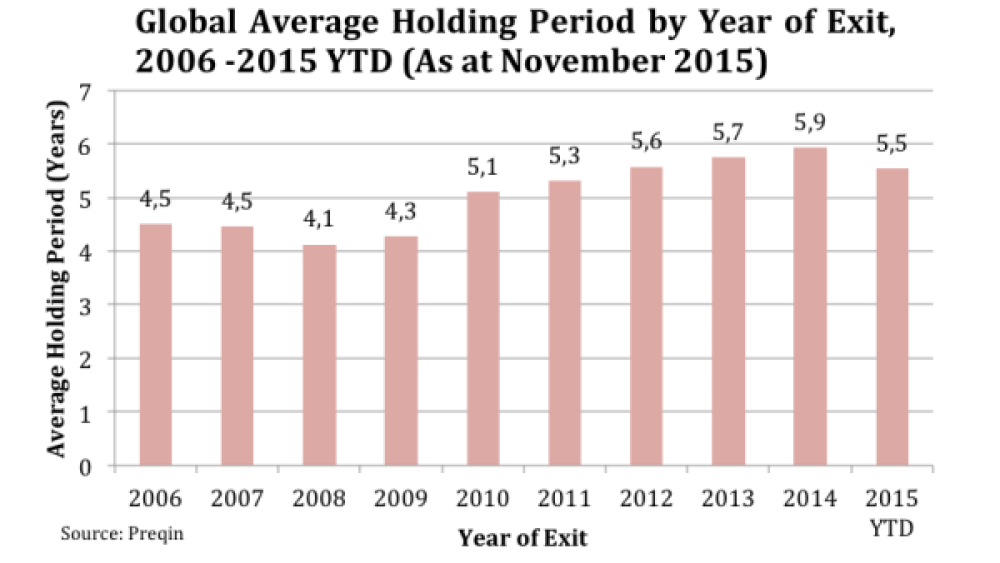

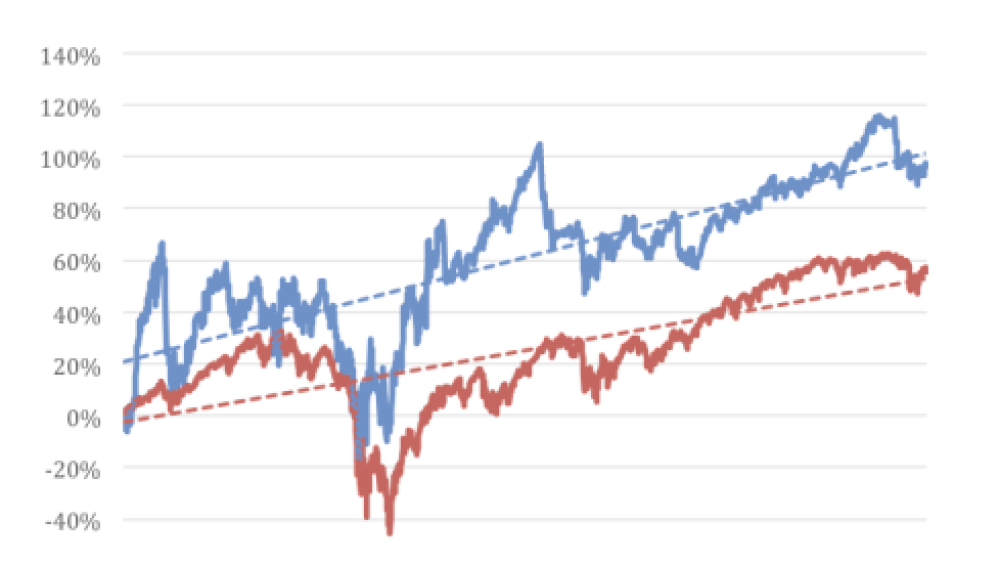

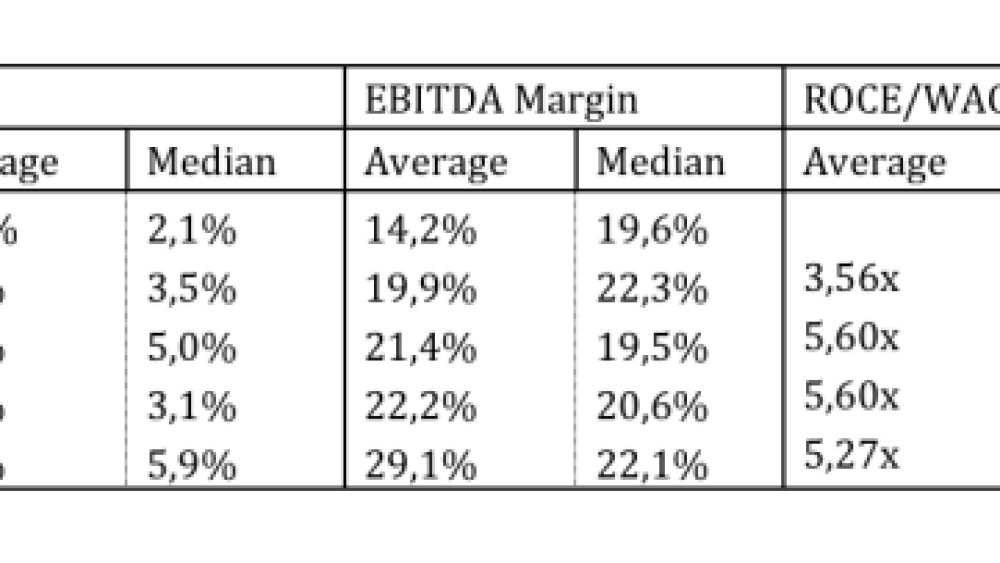

13.06.2016IPO exits to private equity investments are getting more popular each day. Even though under proper market conditions returns to the sponsor can be higher than other exit strategies, they are not necessarily beneficial to public off-takers every time. Indicators lie within the private period.

Some private equity firms are known to have an evil image in the eyes of the market. Their specific point of view on portfolio companies put their motives in question when the stock market and public interest are concerned. The focus of this paper is to analyze the stock performance of a sample of portfolio companies, which are later offered to the public via an IPO, and the uncertainties of the private period from an objective stock market point of view. The sample selected includes exclusively Reverse LBO companies which can largely be defined as companies that were held by private equity firms ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)