Investment

Machine Learning Applied For Pairs Trading

Créé le

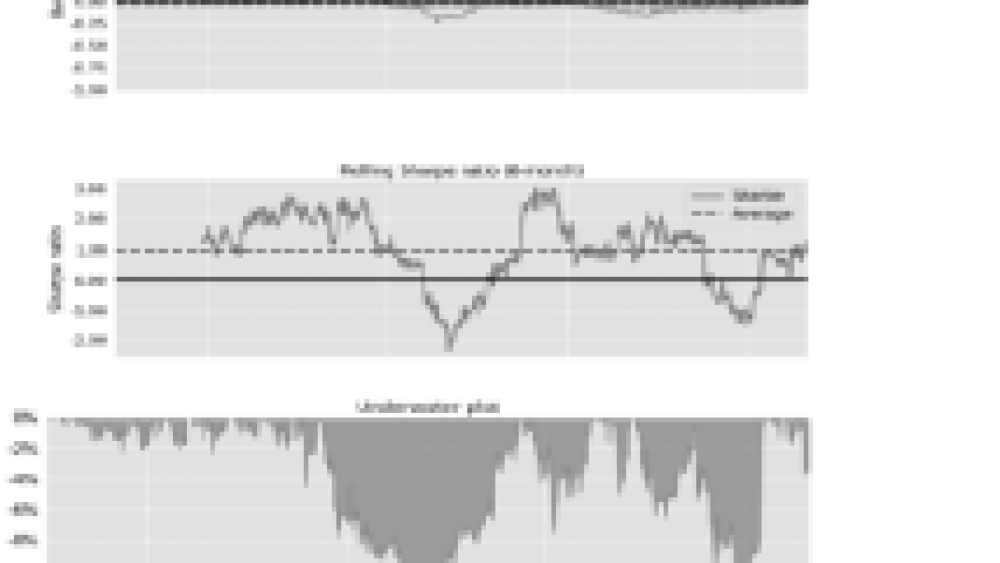

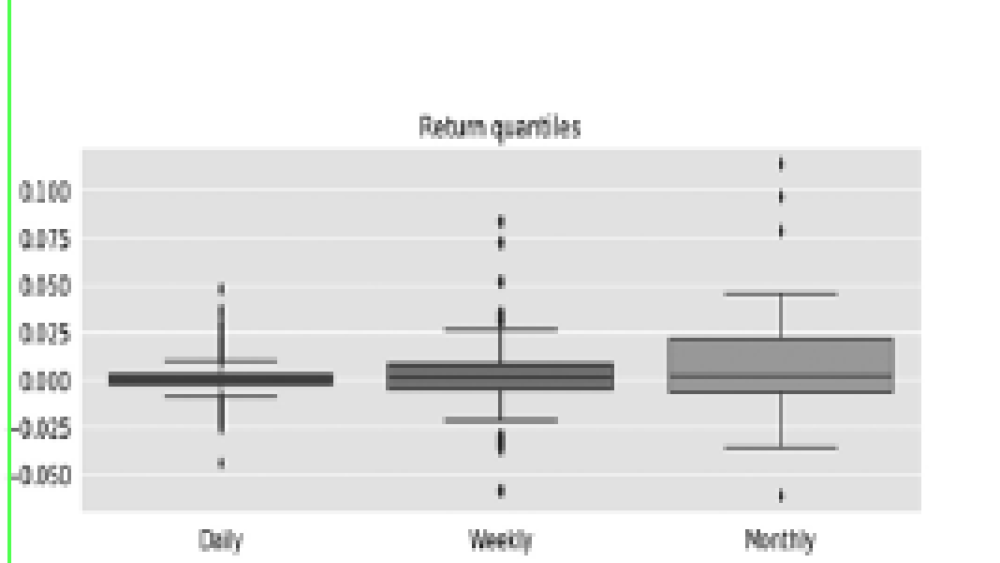

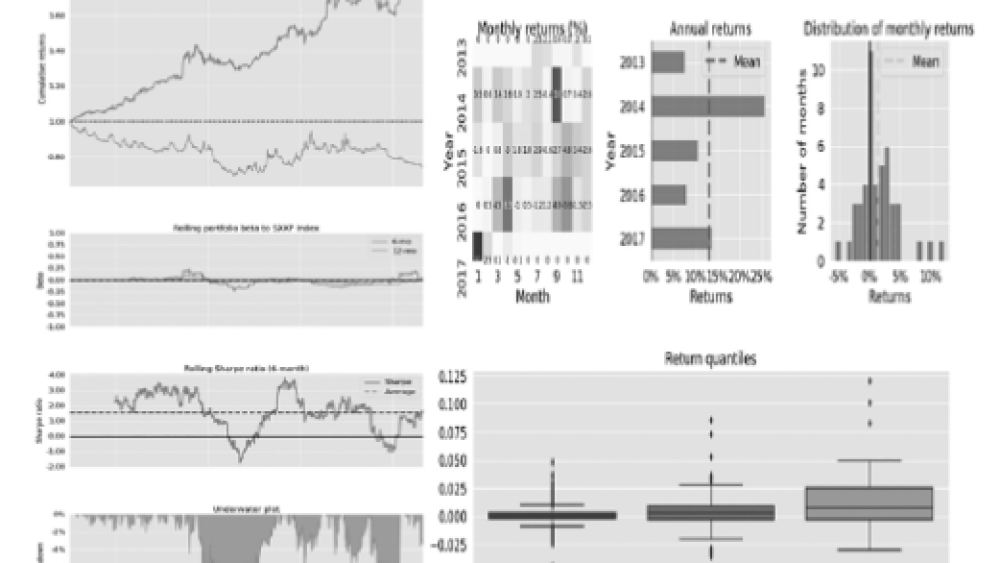

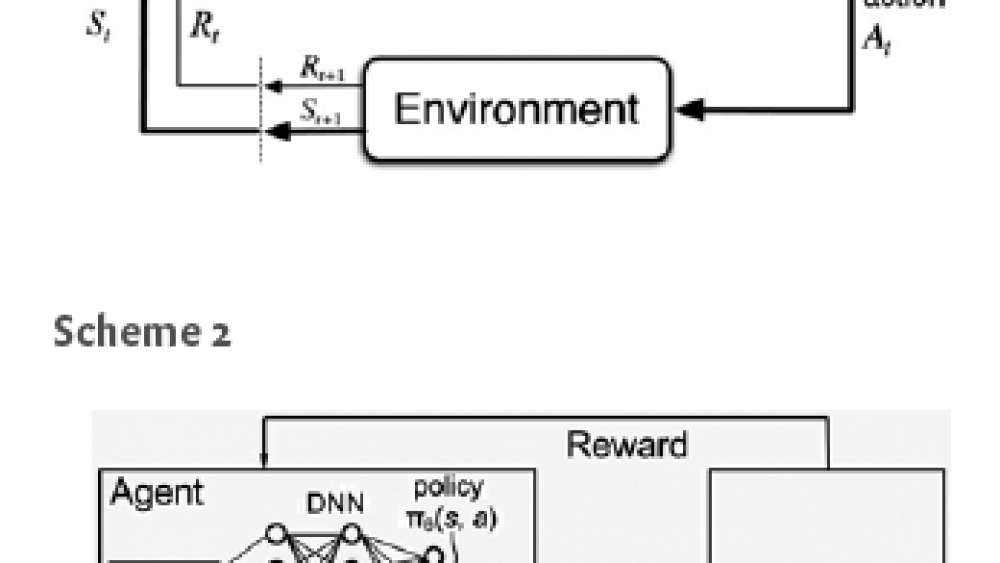

08.07.2020This article deals with machine learning applied for pairs trading. Pairs trading is a hybrid investment category combining the advantages of long/short strategies and of the decorrelation to the markets.

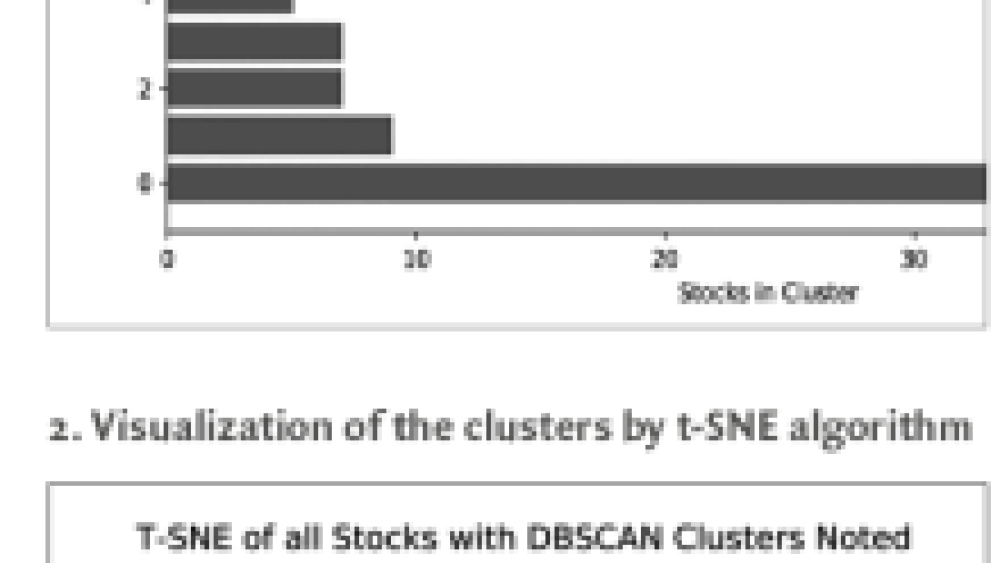

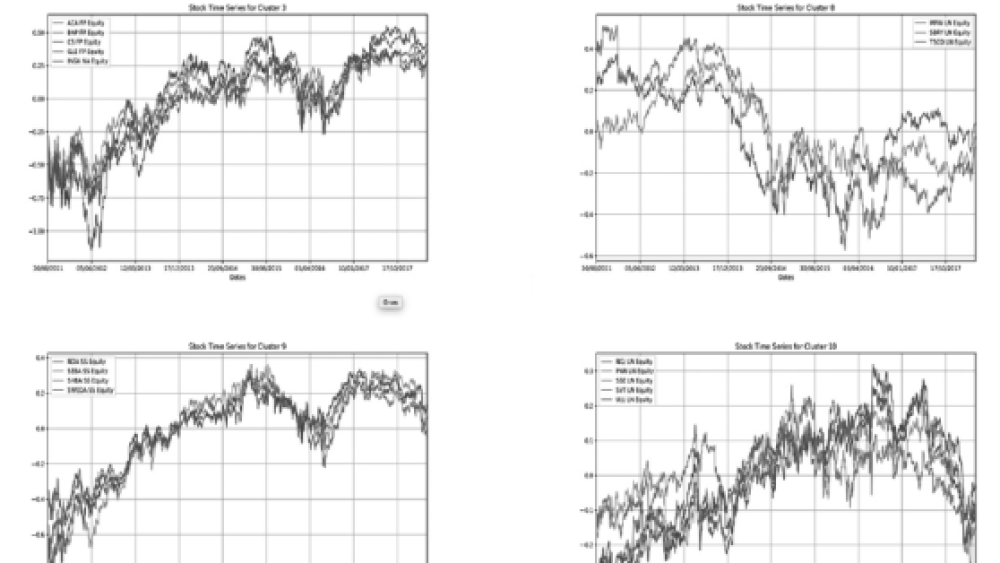

The goal of this thesis is composed of two main parts: the filtering part that eliminates a majority of pairs, and the implementation of the trading strategy. Pair trading is known as market neutral strategy therefore we can neglect beta of the market and generate uncorrelated returns (alpha) with minimal exposure to the market, the identification of pairs and implementation are complex, and the cointegration relationship that allow to characterize the good pairs can break in a short period of time.

While pairs can be chosen either based on fundamentals or statistics, an approach combining both ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)