Cryptocurrency

Evolution of Bitcoin Dynamics

Créé le

05.07.2018-

Mis à jour le

22.08.2018L’étude des determinants du prix du bitcoin sur la longue période de 2011 à 2017, avec un focus particulier sur l’année dernière, permet d’analyser si son prix est correlé à des facteurs économiques fondamentaux ou s’il représente un actif purement spéculatif.

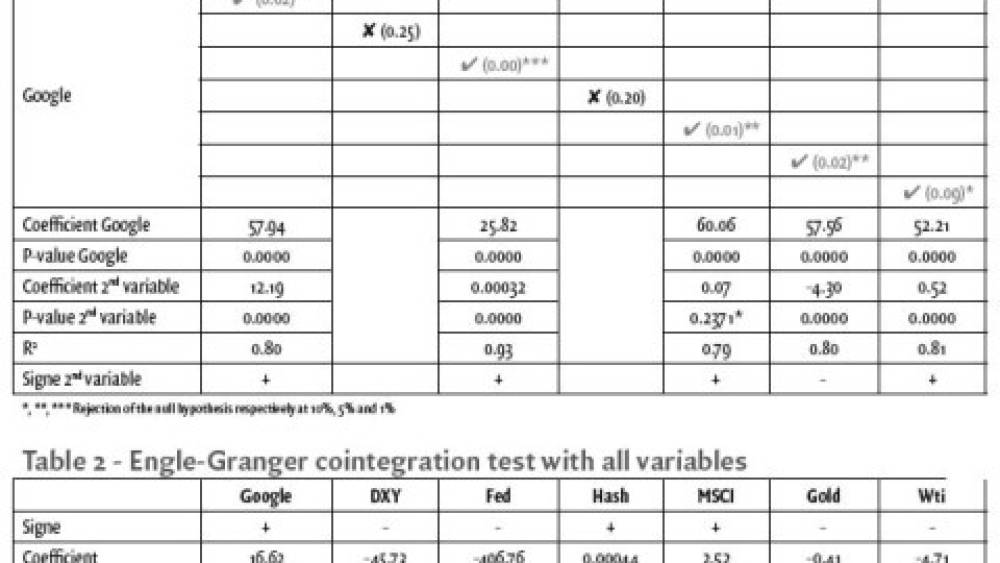

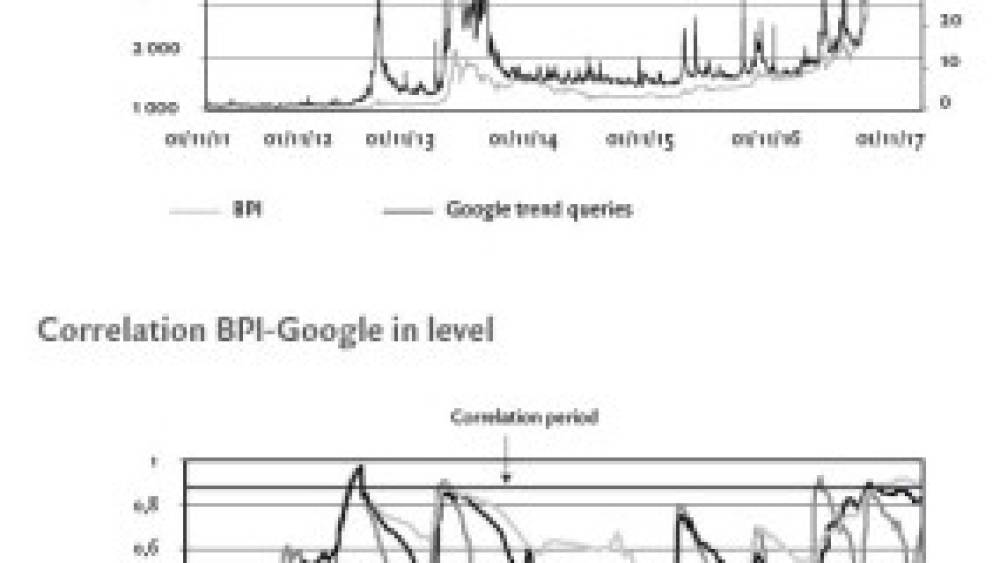

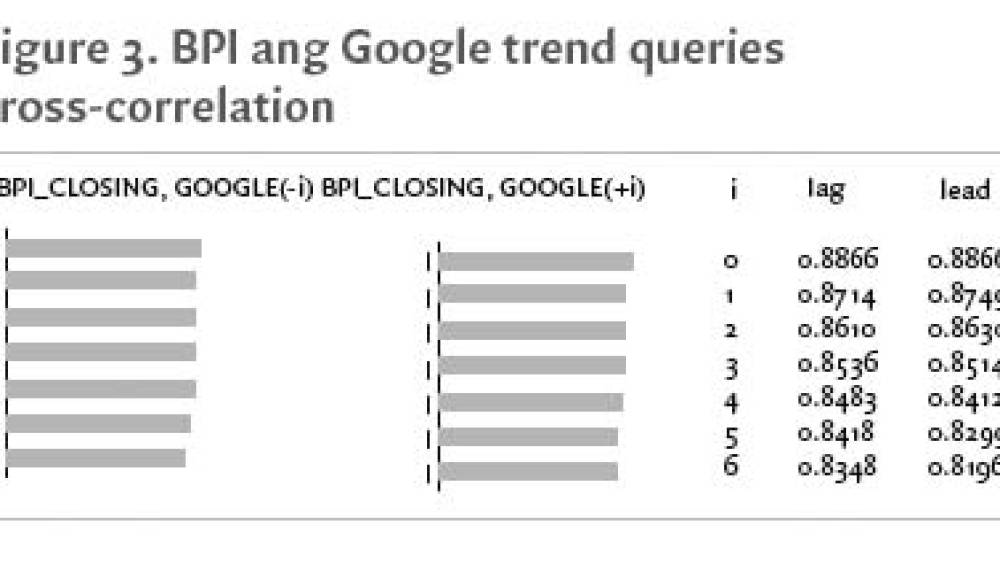

The recent progression of Bitcoin price attracted investors’ interest but also raised the question of a possible bubble. In most research articles Bitcoin price determinants are reviewed on short periods of time until 2015. In this paper, Bitcoin price dynamics are studied on a longer period from 2011 to 2017 focusing on the past year when its price saw a rapid growth. Long-term relationship between Bitcoin price and fundamental sources are studied using econometric tests. Overall, results indicate that Bitcoin does not have a strong correlation with any fundamental factors but investors’ ...