Carbon market

The European Union Emission Trading Scheme: Market Efficiency and Price Drivers

Créé le

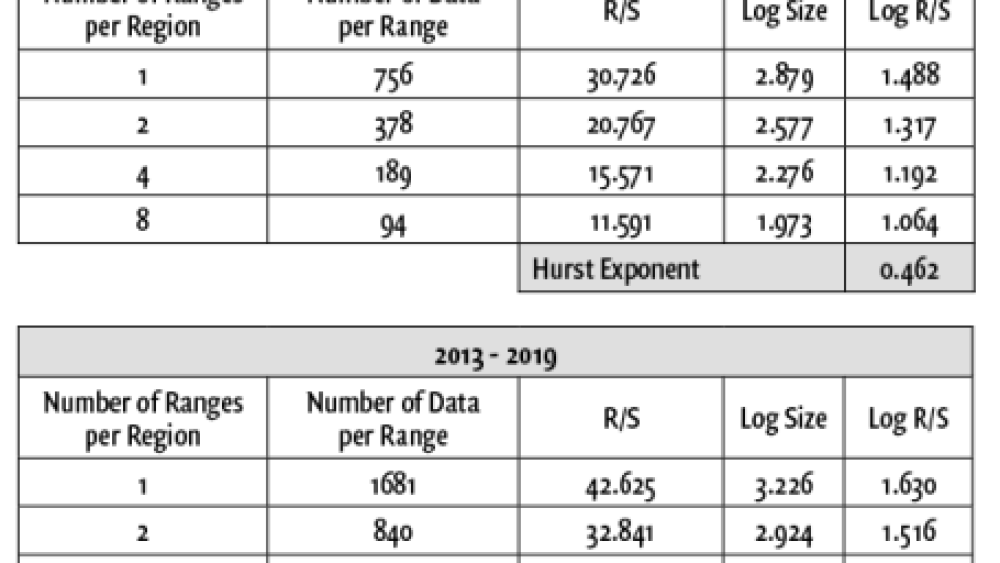

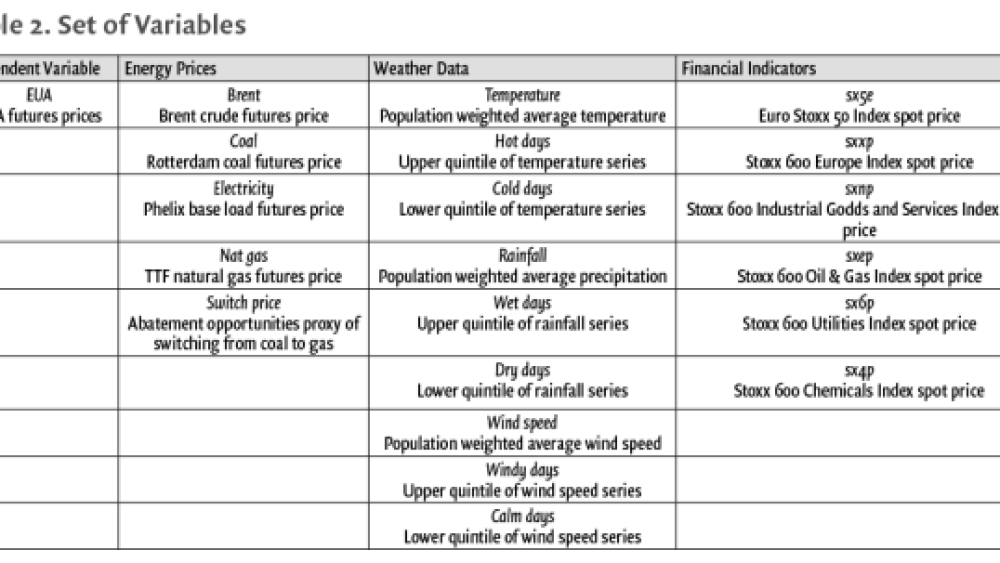

29.06.2020The study of the European Union Emission Trading Scheme (EU ETS) across its current and previous phase allowed us to evaluate carbon market efficiency and identify carbon price drivers. The results show that the European carbon market is approaching maturity and improving over time, and that the most stable carbon price long-term drivers across these two phases are the electricity price and the Stoxx 600 Utilities Index (SX6P) value.

Climate change is today one of the biggest, if not the main, concerns of our century. Since the late 1990’s, we have witnessed several attempts to slow global warming down and reduce greenhouse gases concentration in the atmosphere. These attempts are classified into two categories: emission trading systems and carbon taxes.

In emission-trading schemes, such as the EU ETS, the total level of greenhouse gases emissions is capped such that industries with low emissions can sell their surplus of allowances to larger emitters. A market price for greenhouse gases emissions is then implemented ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)