Market efficiency

Can the Distressed Debt Market be Considered as an Imperfect Market for a Market Maker?

Créé le

07.12.2016-

Mis à jour le

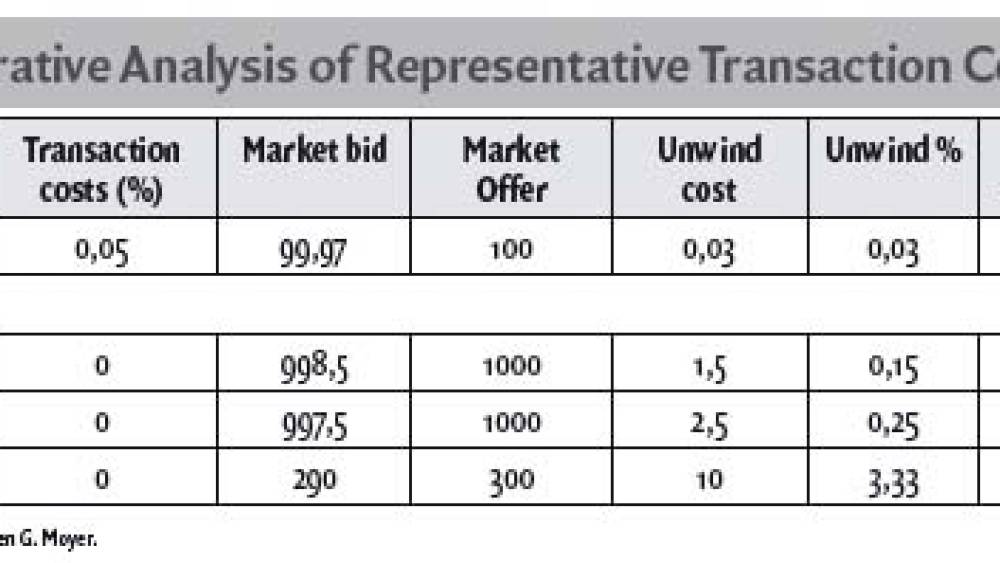

12.12.2016Le texte analyse l’imperfection du pricing des obligations distressed en se focalisant sur les particularités de ce marché, mais aussi sur les enseignements de la théorie économique.

Economic theory defines different types of market efficiency:

Strong: all the public and private information is taken into account in the market price; Half-strong: only the public information affects assets’ prices; Weak: only the past information is priced by the market. Here we chose to take the hypothesis which is the most accepted by the finance community: the semi-strong hypothesis. So, we’ll consider that market prices are driven only by the public information available and so active investor have a role to play. However, if the access to information is without any doubt ...

![[Web Only] Tarifs bancaires : les banques amortissent l’inflation [Web Only] Tarifs bancaires : les banques amortissent l’inflation](http://www.revue-banque.fr/binrepository/480x320/0c0/0d0/none/9739565/MEBW/gettyimages-968963256-frais-bancaires_221-3514277_20240417171729.jpg)