Upskilling

The impact of digitalization on human resources

Créé le

03.09.2018-

Mis à jour le

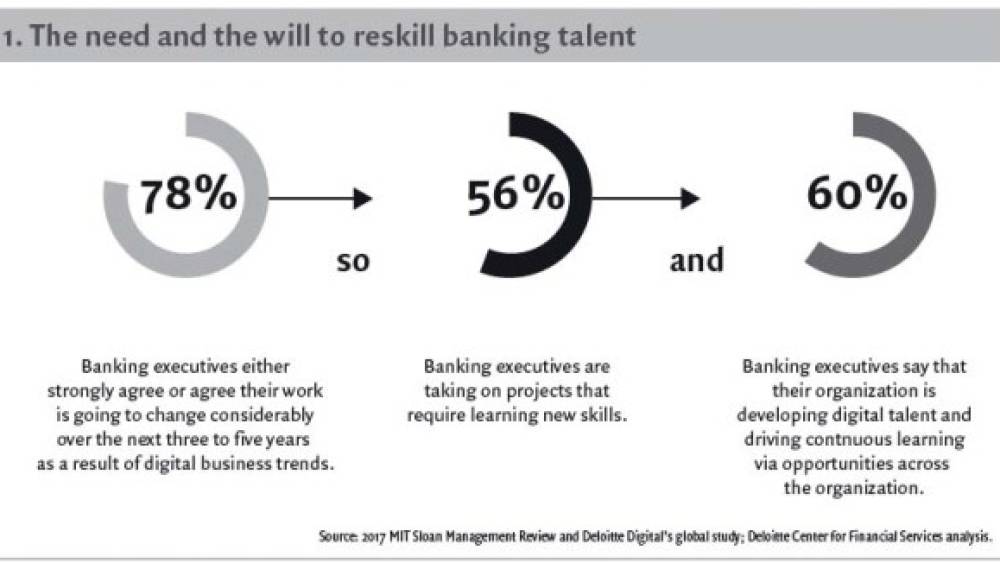

14.09.2018Banks should consider rethinking their workforce strategy given how work is evolving – with increasing automation* and greater diversity in the labor pool.

There is little doubt that automation is rapidly transforming work, and advances in technologies such as quantum computing will likely only accelerate this change. A seemingly natural reaction to the inevitability of an increasingly automated world could be to speculate about the impact on jobs,[1] yet alleviating “automation anxiety” in banking is far from new.[2] For example, ATMs allowed banks to reorient tellers to sales and advisory roles from purely transactional activities.[3]

Redesign work for technology and learning

To take effective advantage of technology, banks will ...